does td ameritrade report to irs

Does Ameritrade report to the IRS. Attach your summary statement to Form 8453 and mail both forms to the IRS.

Td Ameritrade Review A Robust Investing Platform

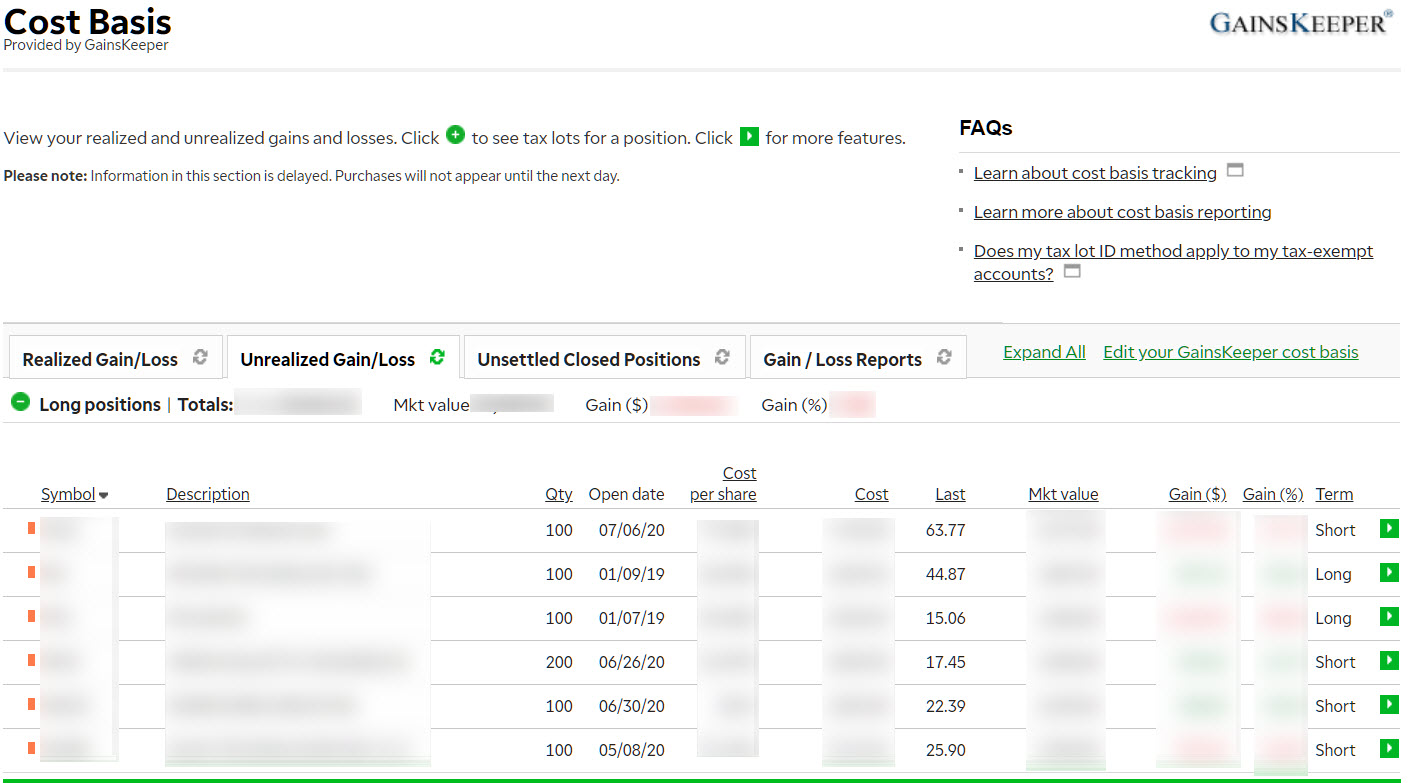

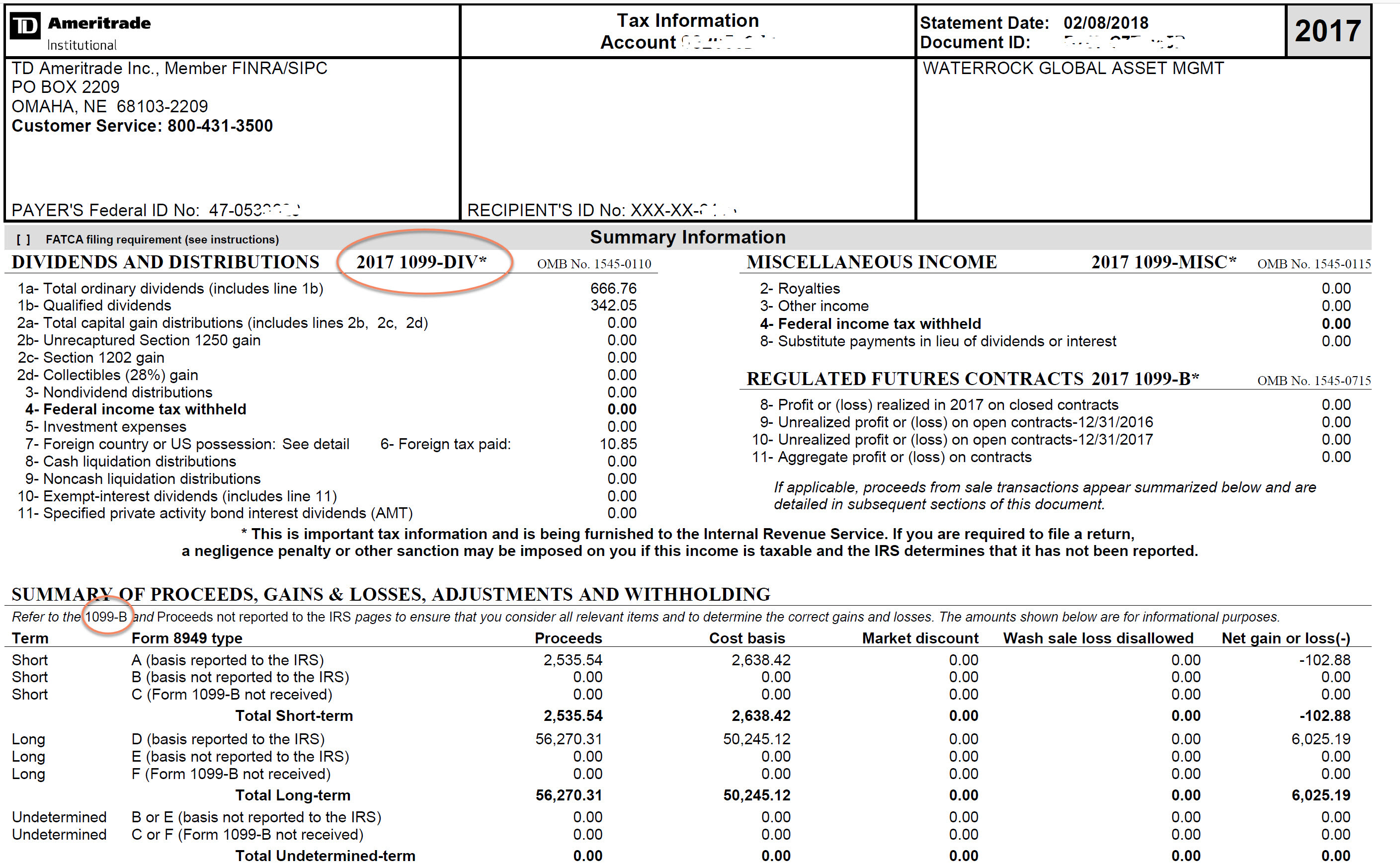

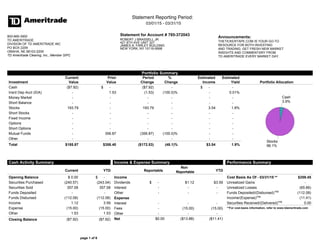

TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information.

. Download this file and submit it for processing by our program. Upon settlement youll find the lots you selected applied to the Realized GainLoss tab and TD Ameritrade will send your selection on to the IRS once tax reporting time rolls around. TDAmeritrade says IRS wants to tax the Schedule K1 in IRA unrelated business taxable income.

If youre mailing your tax return be sure to attach your summary statement to your mailed tax return. In other cases TD Ameritrade Clearing Inc. No you still have to report them.

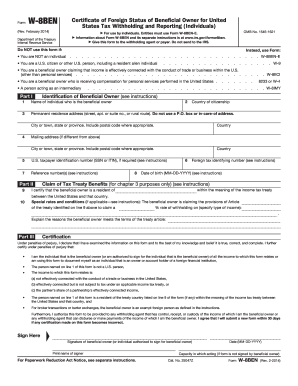

The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Understanding Form 1040. Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content.

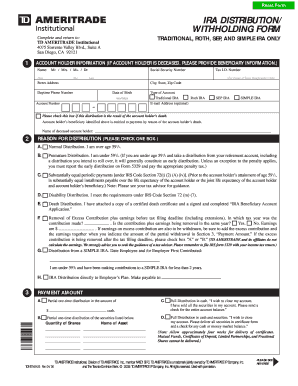

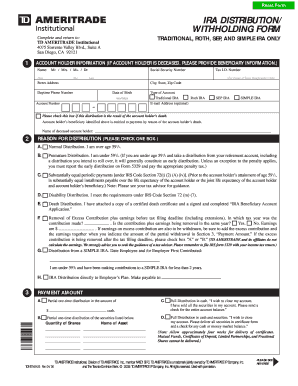

Is required by federal andor state statutes to withhold a percentage of your IRA distribution for. Can I enter K1 in turbotax and click the IRA for the K1 to do the taxes. Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years.

The detailed dividend statement you only need total qualified. Does TD Ameritrade take taxes. October 17 2022 Filing deadline for individuals who have automatic 6-month extensions may differ for those outside the United States Deadline to remove excess or recharacterize IRA.

You pay tax on it if you profit income tax rate if short term capital gains. There are two places where the 1099 B might show not reported to the IRS. On my 1099 with TDA it shows an amount in Wash Sale Loss Disallowed on the basis reported to IRS line even though I held zero positions and all cash between 1130 and 12312021.

The topic of this. Have you talked to a tax professional about this. TD Ameritrade does not report this income to the IRS.

Td Ameritrade Estate Department Form Fill Out And Sign Printable Pdf Template Signnow

Td Ameritrade Review A Robust Investing Platform

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Irs Form W 8ben Td Ameritrade Fill Online Printable Fillable Blank Pdffiller

Help Creating An Account R Tdameritrade

Td Ameritrade Trek Client Learning Center

Tax Documents To Bring Pacific Northwest Tax Service

Can Someone Explain Why There Was A Wash Sale Adjustment Made Here The First Two Sell Orders Were For Profit But I Wanted To Realize The Highest Loss On My Third Sell

Td Ameritrade There May Be A Way Around The Penalty If You فېسبوک

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Td Ameritrade Forms Fill Out And Sign Printable Pdf Template Signnow

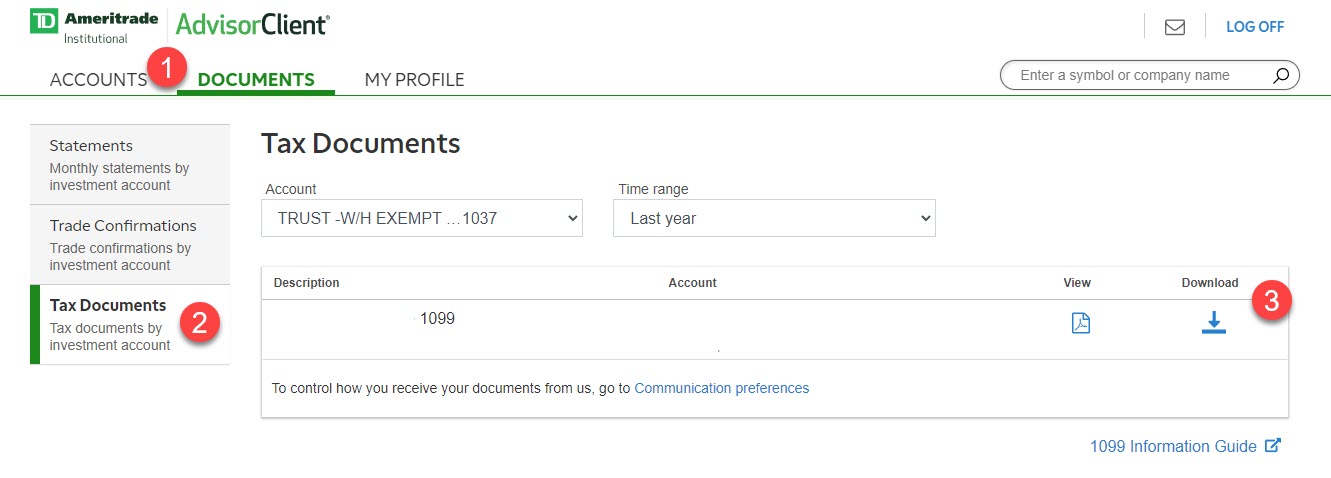

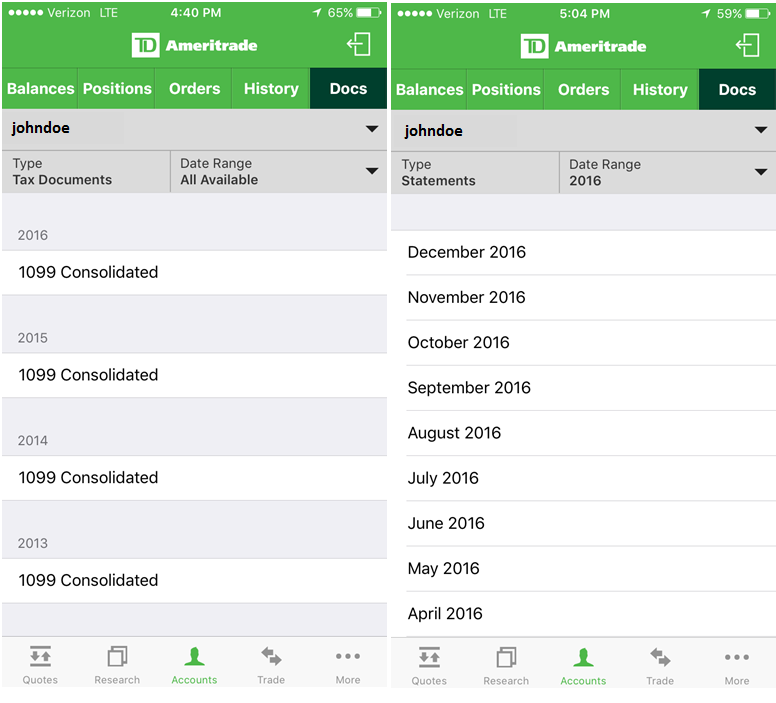

Get Real Time Tax Document Alerts Ticker Tape

How To Process A Td Ameritrade Conversion Of Voluntary After Tax Solo 401k Funds To A Roth Solo 401k My Solo 401k Financial

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Td Ameritrade Says I Made 196k In 3 Months R Tax

Td Ameritrade For International Non Us Citizens 2022

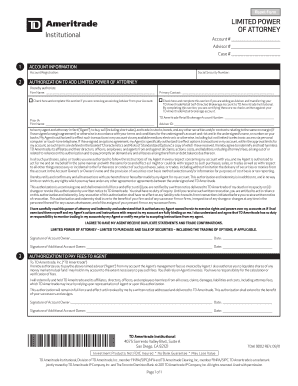

Fillable Online Td Ameritrade Limited Power Of Attorney Strategic Money Report Fax Email Print Pdffiller