tax shield formula cpa

Will receive as a result of a. The tax shield Johnson Industries Inc.

What Is Agi Universal Cpa Review

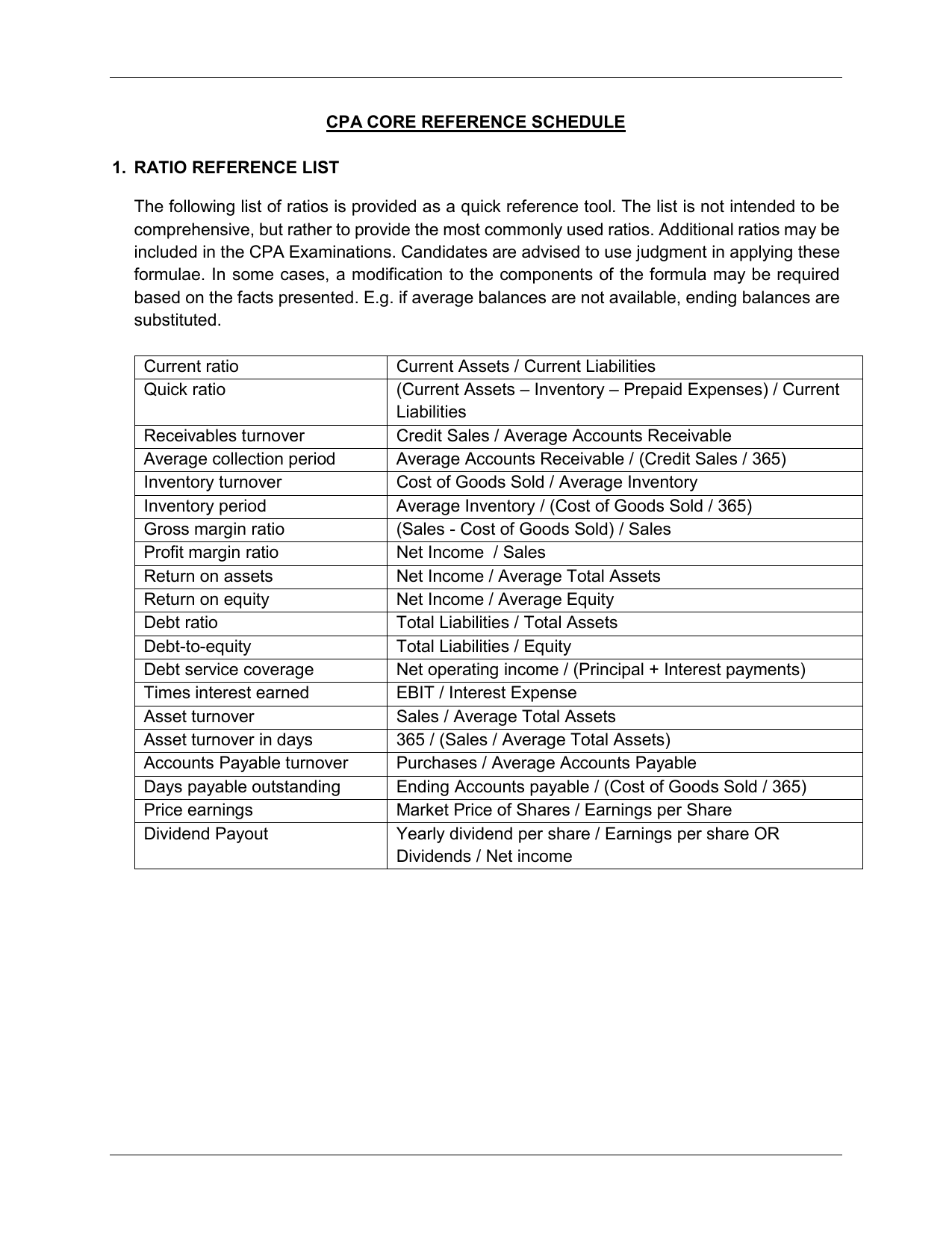

CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords.

. Ad Owe Over 10K in Back Tax. Calculation of the tax shield follows a simplified formula as shown below. Operating Profit is calculated as.

As such the shield is 8000000 x 10 x 35 280000. The effect of a tax shield can be determined using a formula. Connect with a Accountant instantly.

The tax rate for the company is 30. Depreciation Tax Shield Depreciation Applicable Tax Rate. Calculating the tax shield can be simplified by using this formula.

YEARS IN BUSINESS 703 723-9651. Tax Shield Amount of tax-deductible expense x Tax rate. Learn more about our cloud-based solutions today.

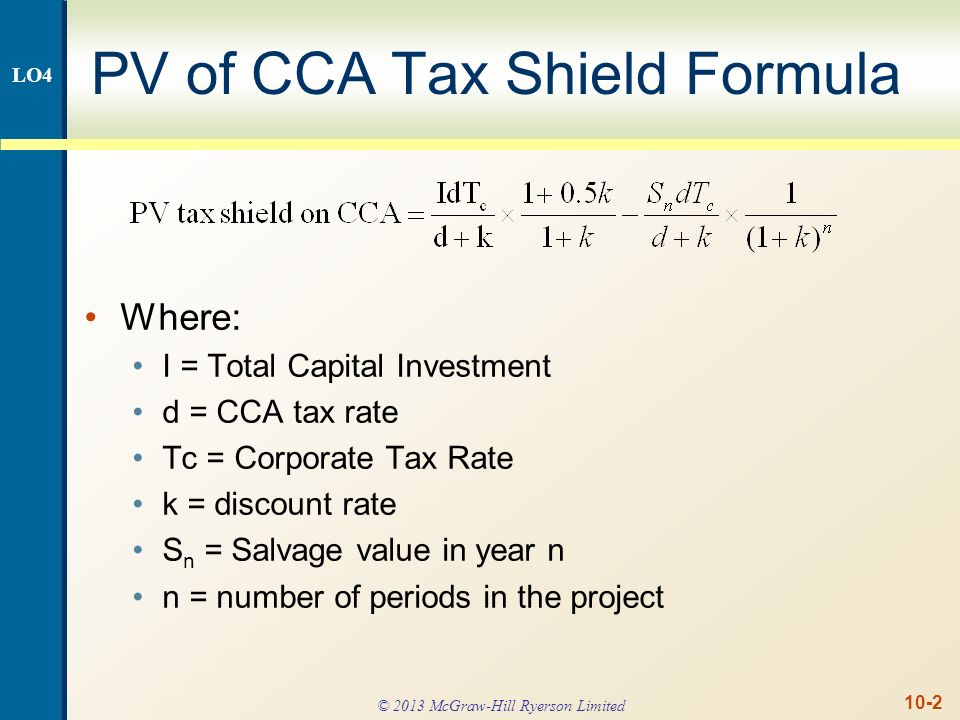

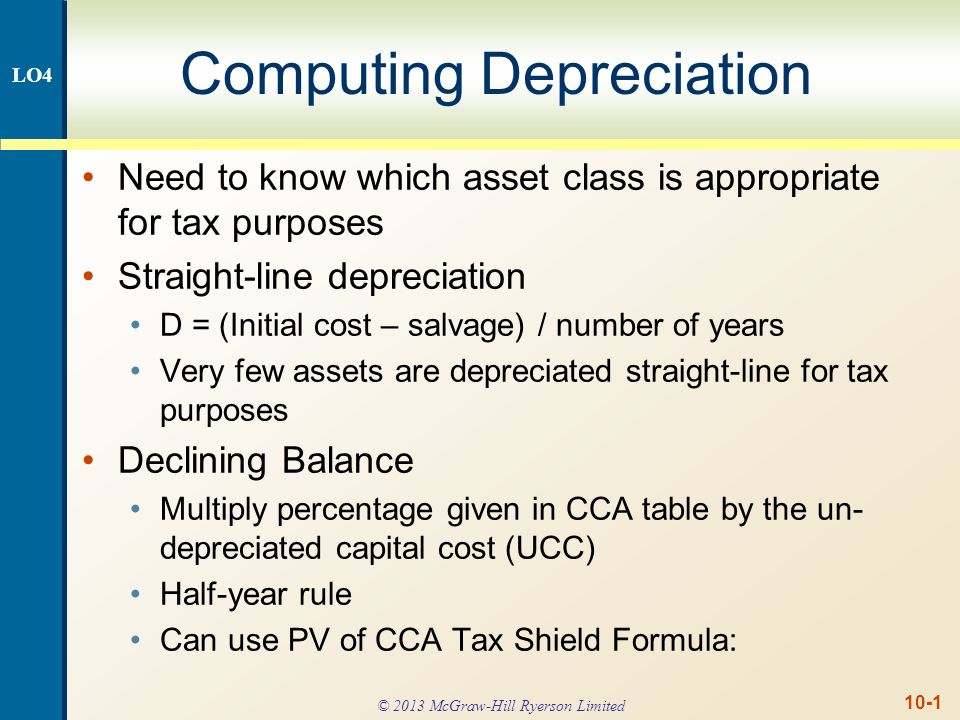

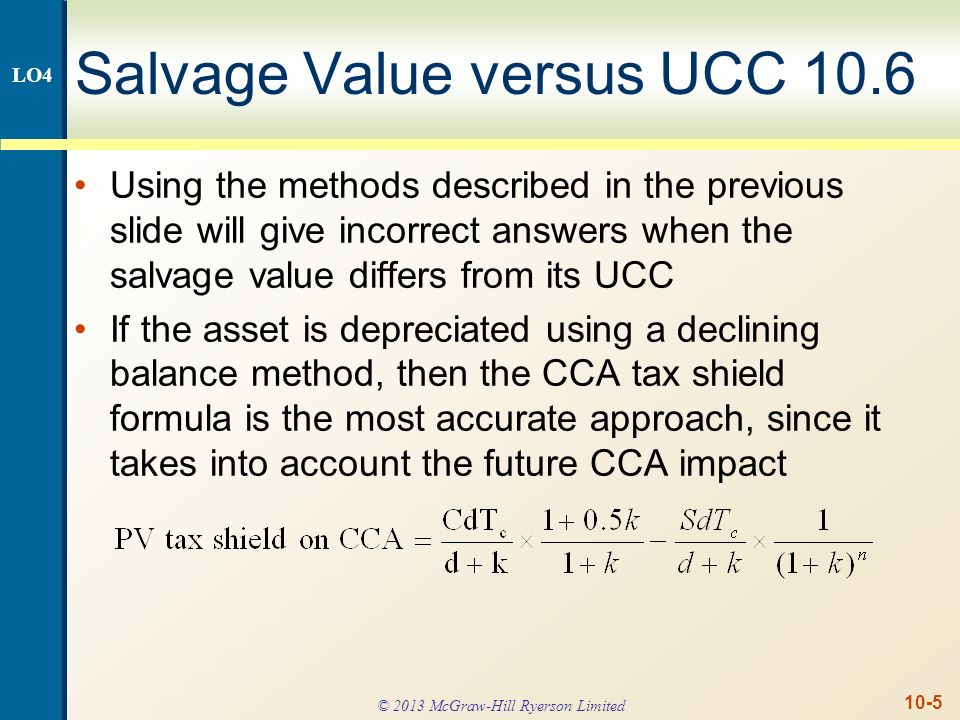

Taxes-Consultants Representatives Accountants-Certified Public Accounting Services. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new.

Tax shields are a strange mix of accounting and accrual. The maximum depreciation expense it can write off this year is 25000. Or we can say it is the reduction in the assessable income because of the use of.

The formula for calculating a depreciation tax shield is easy. The textbook formula includes the tax shield with the 1-T factor affecting the contribution of debt to the WACC. 22066 Auction Barn Dr.

Let the Experts Help. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. This is usually the deduction multiplied by the tax rate.

Start crossing things off your list today. Depreciation tax shield 30 x 50000 15000. A Tax Shield is the use of taxable expense that helps a business to lower its tax liability.

How to Calculate Tax Shield. Investment Cost Marginal Rate of Income tax. Schedule your Free Consultation.

TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE. The intuition here is that the company has an. The applicable tax rate is 37.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. As such the shield is 8000000 x 10 x 35 280000. Learn How You Can Benefit From The Benefits Of Cloud-Based Tax Software Online.

CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1. This is equivalent to the 800000 interest expense multiplied by 35. Let us look at a detailed example when a company prepares its tax income 1 accounting for depreciation expense and 2 not.

Tax Shield formula. Ad Free price estimates for Accountants. This is equivalent to the 800000.

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective. Depreciation Tax Shield 20000.

Ad What are the tax implications. YEARS IN BUSINESS 703 723-3100. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the.

Present value PV tax shield formula. Interest Tax Shield Interest Expense Tax. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If. Free estimates no guessing. Depreciation Tax Shield 100000 20.

Owe 10K in Back Taxes. Tax Shield Deduction x Tax Rate. Ashburn VA 20147.

CCA Tax Shield Notes - Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax rate 10 discount rate Year UCC CCA. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

Tax Accounting Payroll Services Inc. So the total tax shied or tax savings available to the. CPA CFE REFERENCE SCHEDULE 2018 1.

Thus if the tax rate is 21 and the business has 1000 of interest. Let Our Experts Help.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Definition Formula Example Calculation Youtube

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Depreciation Tax Shield Depreciation Tax Shield In Capital Budgeting

Cca Tax Shield Formula Pdf Public Finance Taxation

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

G10488 Ec Pep Core Reference Schedule En

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)